If a Company Fails to Record Estimated Bad Debts Expense

Up to 256 cash back 32. In addition they help companies recognize customers who defaulted on payments to avoid similar situations in the future.

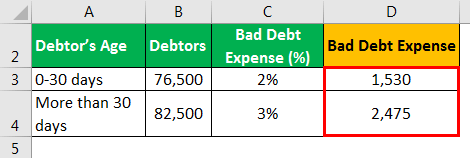

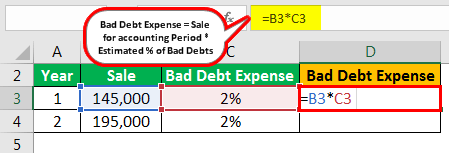

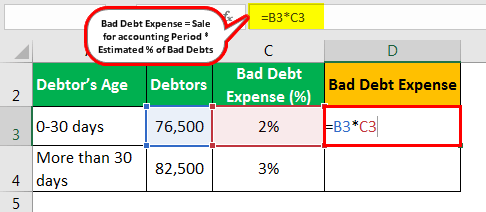

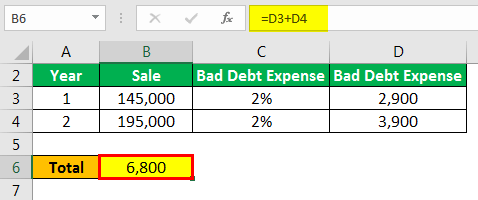

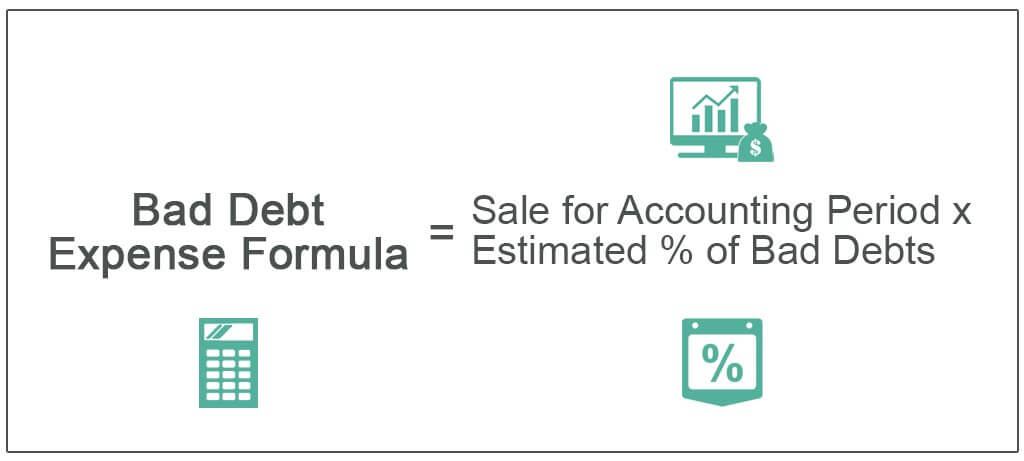

Bad Debt Expense Formula How To Calculate Examples

A significant amount of bad debt expenses can change the way potential investors and company executives view the health of a company.

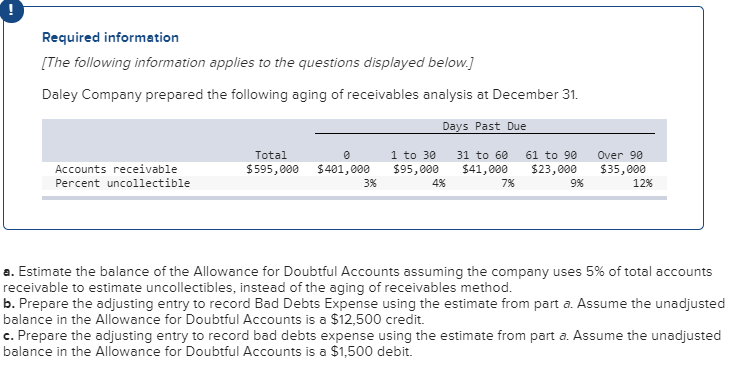

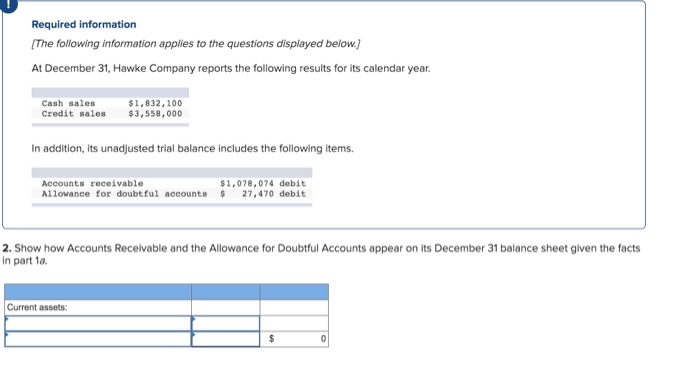

. If a company fails to record its estimated bad debts expense then its accounts receivable cash realizable be expenses are overstated. Reporting 8 - 11. Multiple choice a sale is made.

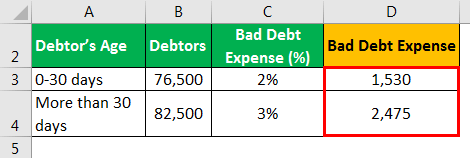

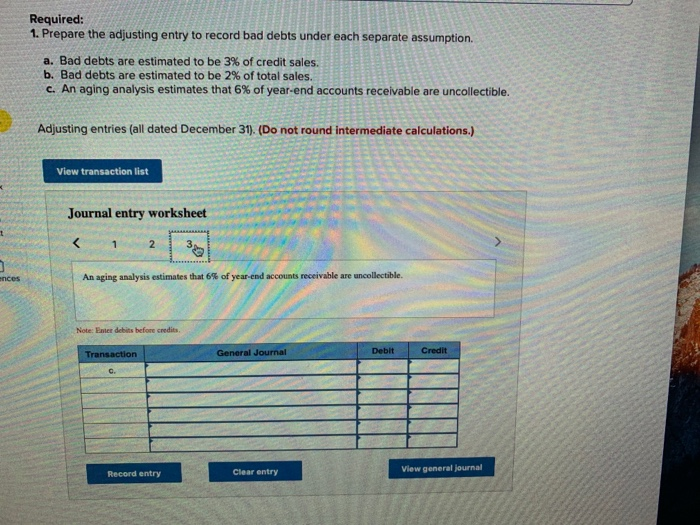

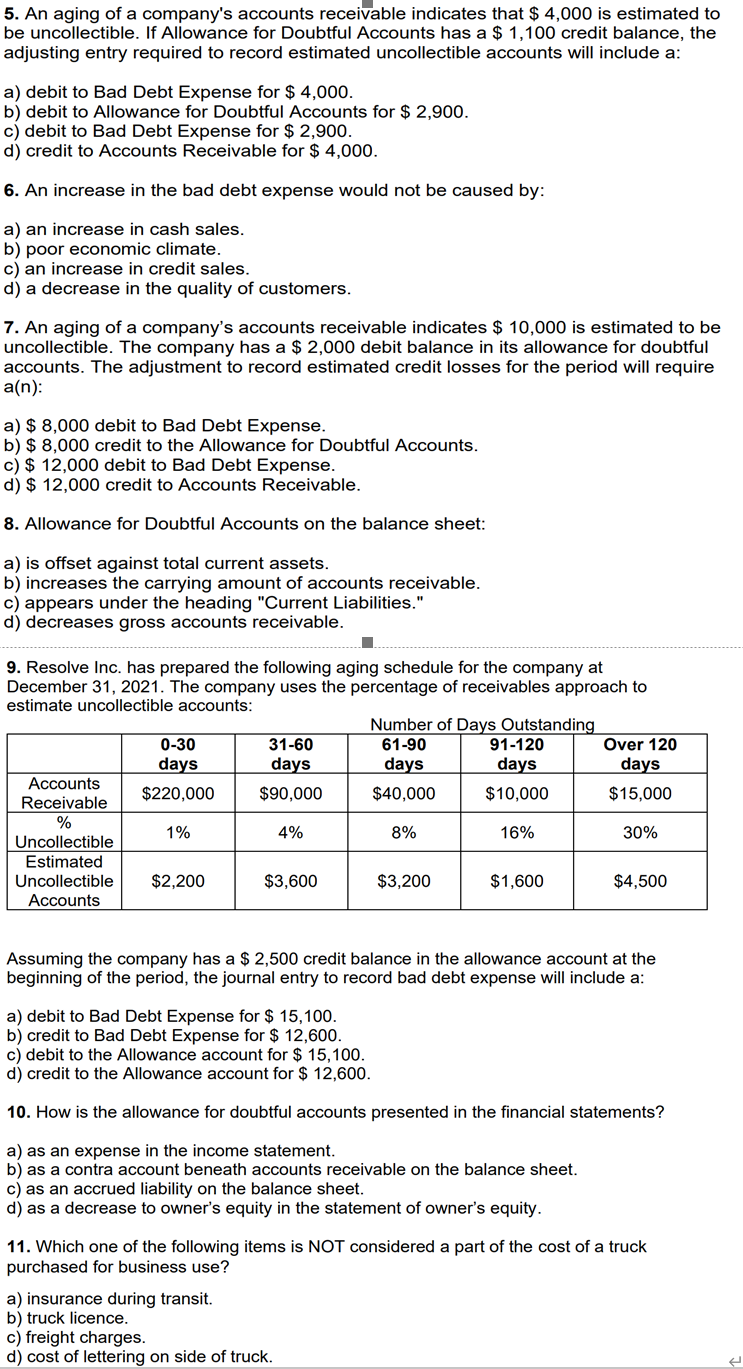

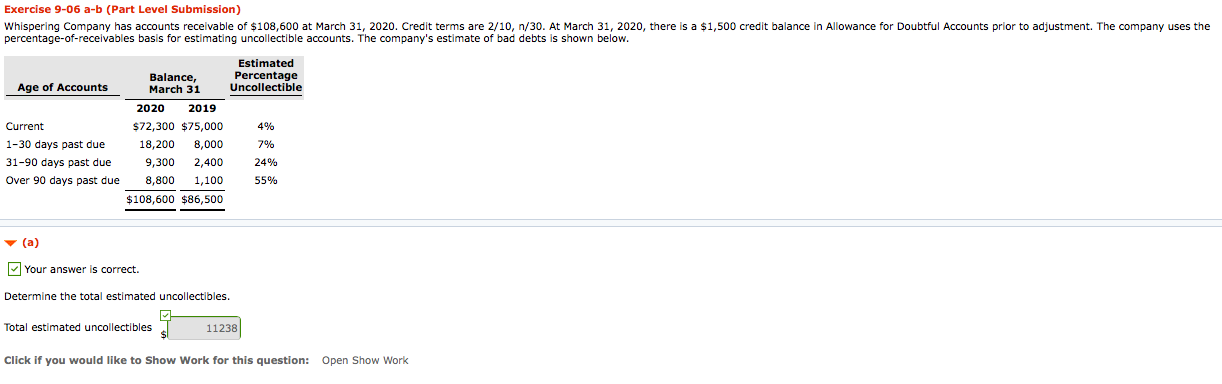

Leary Corporation had net credit sales during the year of 1200000 and cost of goods sold of 720000. If a company uses the allowance method to account for uncollectable accounts the entry to write off an uncollectable account only involves balance sheet accounts. An aging of a companys accounts receivable indicates that 9000 are estimated to be uncollectible.

Voight Companys account balances at December 31 for Accounts Receivable and Allowance for Doubtful Accounts were 1400000 and 70000 Cr respectively. LegalRegulatory Perspective AICPA FN. If a company fails to record estimated bad debts expense a cash realizable value from SOCIAL 95123654 at Foreign Trade University.

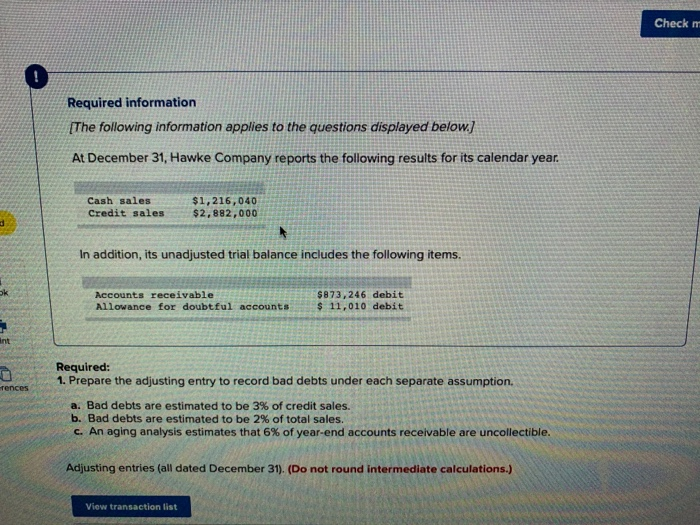

If a company fails to record estimated bad debt expense expenses are understated 14. If a company fails to record estimated bad debt expense a. As you can see 10000 1000000 001 is determined to be the bad debt expense that management estimates to incur.

If a company fails to record estimated bad debt expense are expenses understated of overstated. The existing balance in Allowance for Doubtful Accounts is considered in computing bad debt expense in the. When the allowance method is used to account for uncollectible accounts Bad Debts Expense is debited when.

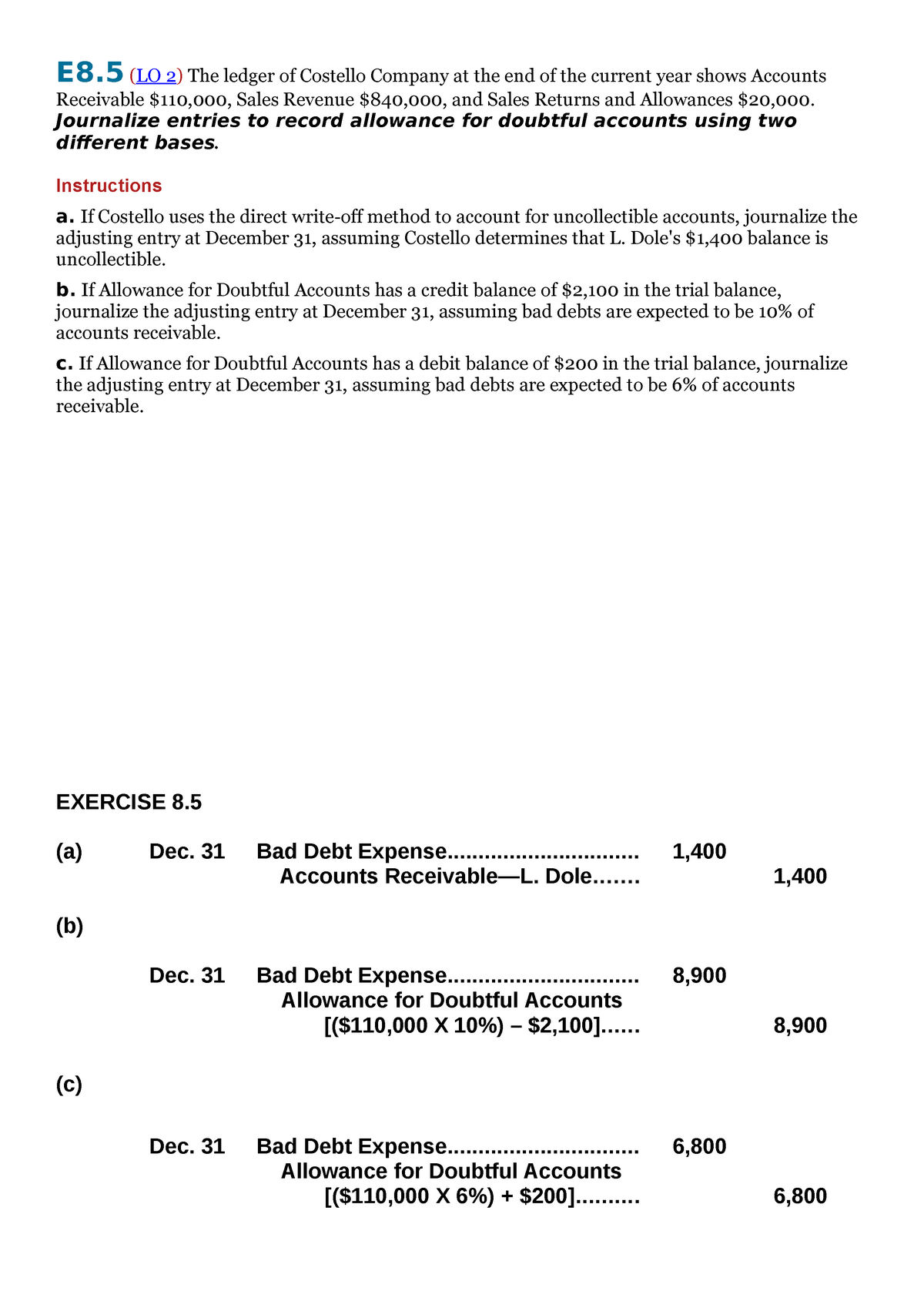

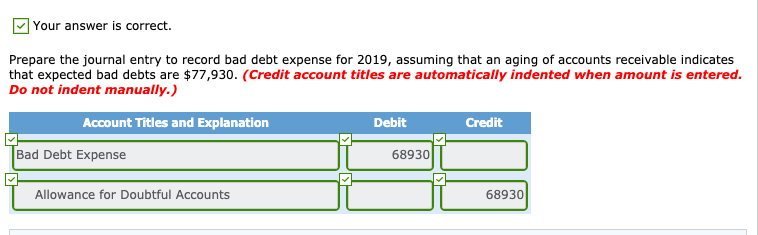

If a company fails to record estimated bad debt expense Acash realizable value is understated. An aging of accounts receivable indicated that 128000 are expected to become uncollectible. On March 31 2017 Corporate Finance Institute reported net credit sales of 1000000.

Multiple choice a sale is made. If a company fails to record estimated bad debts expense at the end of the accounting period. NoteIf a company fails to record estimated bad debt expense then expenses are understated and assets are overstated.

Cash realisable value is understated. The amount of the. If a company fails to record estimated bad debts expense.

Equity is overstated d. Using the percentage of sales method they estimated that 1 of their credit sales would be uncollectible. If Allowance for Doubtful Accounts has a 2400 debit balance the adjustment to record bad debts for the period will require a credit to Allowance for Doubtful Accounts for 9000.

Debit to Bad Debt Expense for 11400. For the above-mentioned reasons it is critical that bad debts are recorded timely and accurately. If a company fails to record its estimated bad debts expense then its a.

If a company fails to record estimated bad debts expense. When the allowance method is used to account for uncollectible accounts Bad Debts Expense is debited when. O equity is overstated cash is overstated.

If a company fails to record estimated bad debts expense. Cash realizable value is understated. Multiple choice net realizable value is understated.

Accounts receivable cash realizable value is understated. Cash realizable value is understated. The following information relates to product J.

Bad debts are recorded as expense in the statement of Profit and L. If a company fails to record estimated bad debt expense then expenses are understated and assets are overstated The existing balance in the Allowance for Doubtful Accounts is considered in computing bad debt expense when using the. If a company fails to record estimated bad debts expense a.

If government regulations make a certain job less dangerous then wed expect that the supply of labor for that job would. Cash realizable value is understated. If a company fails to record estimated bad debts expense a.

Accounting questions and answers. Debit to Bad Debt Expense for 9000. If a company fails to record estimated bad debts expense then anet realizable value is understated.

View the full answer. Both c and d are correct. Multiple choice net realizable value is understated.

Chapter 8 Acc E8 Lo 2 The Ledger Of Costello Company At The End Of The Current Year Shows Studocu

Account For Uncollectible Accounts Using The Balance Sheet And Income Statement Approaches Principles Of Accounting Volume 1 Financial Accounting

Solved 1 Prepare The Adjusting Entry To Record Bad Debts Chegg Com

Bad Debt Expense Formula How To Calculate Examples

Is Accounting A Means And Not An End Explain Accounting Accounting Information Increase

Solved Prepare The Adjusting Entry To Record Bad Debts Under Chegg Com

Answered Your Answer Is Correct Enter The Bartleby

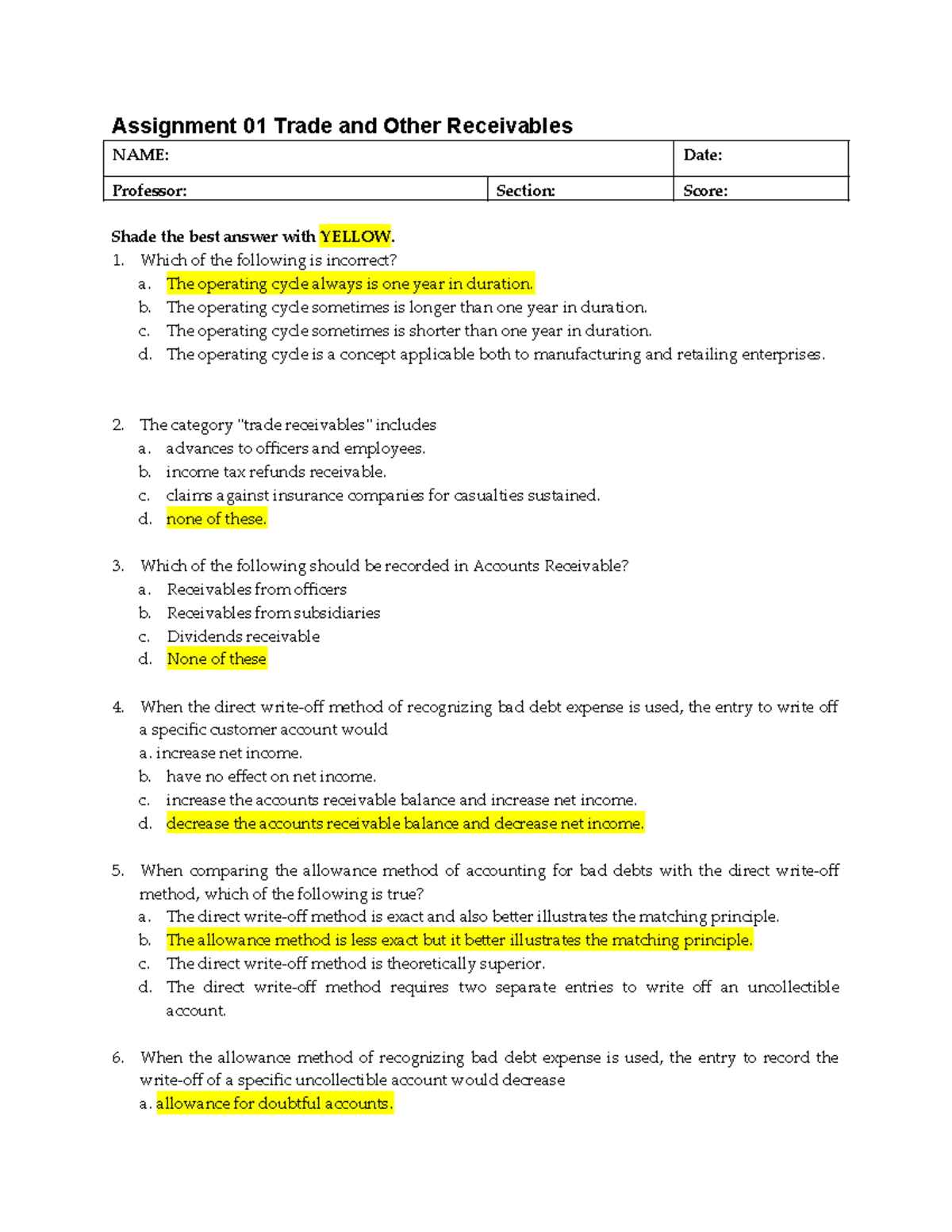

509390911 Acctg 121 Trade And Other Receivables Assignment 01 Trade And Other Receivables Name Studocu

Solved Adjusting Entry To Record Bad Debts Expense Chegg Com

Solved 5 An Aging Of A Company S Accounts Receivable Chegg Com

Bad Debt Overview Example Bad Debt Expense Journal Entries

Bad Debt Expense Formula How To Calculate Examples

Bad Debt Expense Formula How To Calculate Examples

Solved Required 1 Prepare The Adjusting Entry To Record Chegg Com

Solved Please Answer Part B Prepare The Adjusting Entry At Chegg Com

If A Company Fails To Adjust Accrued Expenses In 2021 Accounting Books Accounting Cycle Income Statement

Solved Prepare The Adjusting Entry To Record Bad Debts Under Chegg Com

Comments

Post a Comment